Investing has been solved

1. Time in the market beats timing the market.

2. Diversification is (still) the only free lunch in investing.

3. Investing has been solved, but it's hard.

Important investing lessons

If I come back to a piece of content more than three times, I must share it with the community, that's my rule of thumb.

I watched Ben's video more than 10 times, it's something I put on the TV when i have friends visiting, seven minutes packed with value that stimulates great conversation.

I admire Ben’s work because he goes the extra mile with white paper references. In a world of Helpful Content Update, publication references add legitimacy.

This is my commentary on three out of 20 market lessons from Benjamin Felix.

1. Time in the market beats timing the market.

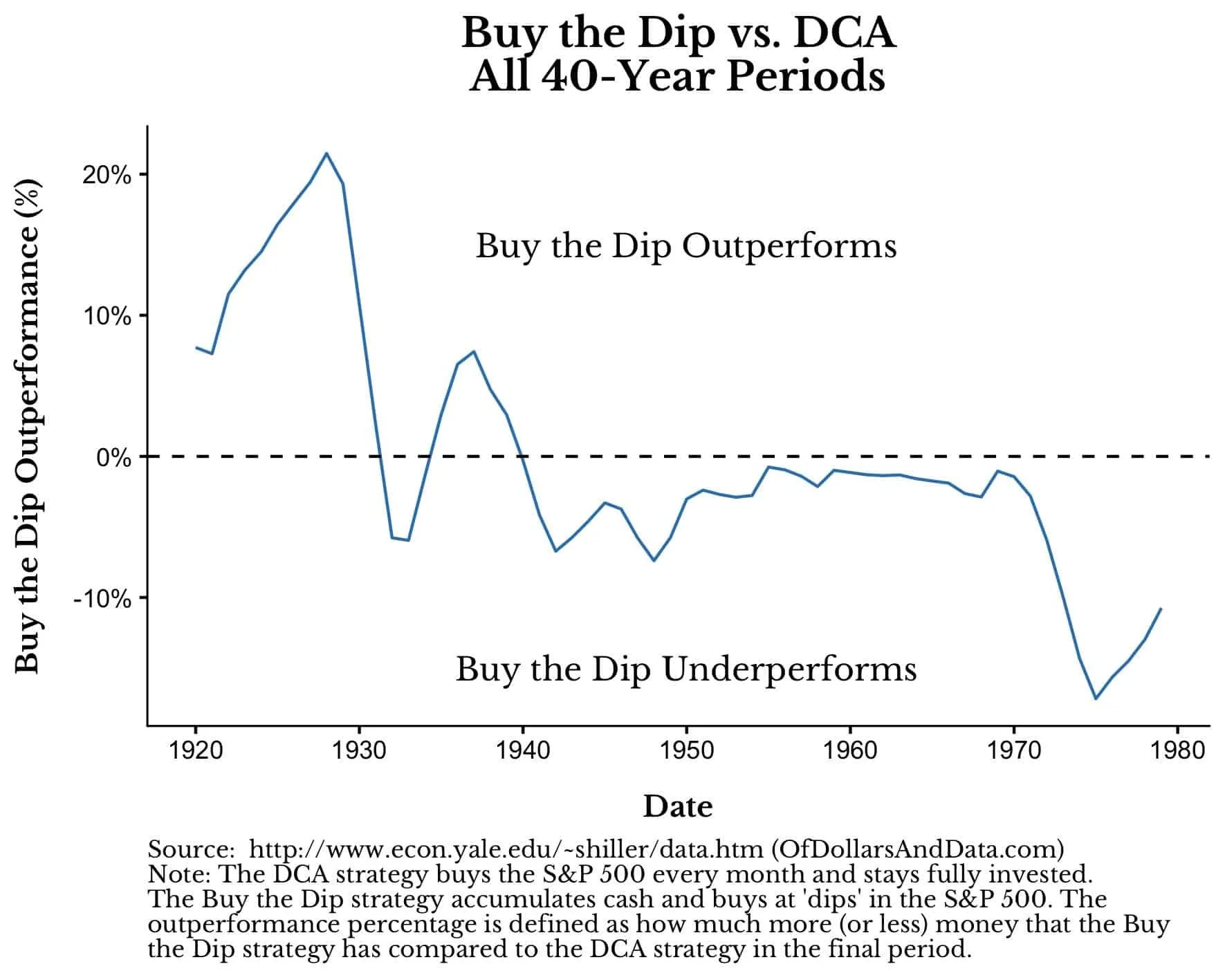

Sticking to a disciplined strategy will typically be more effective than trying to time the market, especially after costing taxes.

Trust the process and exercise patience, time in the market makes the compound effect play in your favor. If you need to visualize this go to money.ca calculator, make projections, and see the snowball effect for yourself.

Buffet started investing at the age of 10 and 95% of his net worth was realized after his 50th birthday.

2. Diversification is (still) the only free lunch in investing.

Diversification has been called the only free lunch investing for decades because it offers the rare opportunity to reduce risk measured by return variance without reducing expected returns.

3. Investing has been solved, but it's hard.

For most people investing in a portfolio of low-cost total market index funds is good enough, even if it’s not perfect.

Index investing is the smartest way for the majority of retail investors.

If it has been solved by indexes like the S&P500, what makes it hard?

Handling emotions that arise with market volatility is what makes patience the most important virtue of great investors.

Standing on the shoulders of giants

When I'm studying super investors, and trying to learn whatever I can from their investment strategy, and where they made the money is by

identifying exceptional businesses, ones that have a long runway of continued growth, ample pricing power, low chance of outside disruption to their business model.

Identifying those companies and at reasonable prices. They don't to get them dirty, but just a reasonable price. You don't want to be paying.com levels or 2021 levels for these companies. So we need to find them. We need to get them at a reasonable price and then buy a decent amount of them.

Make a little bet. We don't have to put all of our net worth in a single company or take any extravagant risk like that, but maybe have a five to 10% position in one of them, and then

Having the discipline to keep our hands off despite bad news or a bad quarter, or growth slowing one quarter, and being able to identify if the key drivers of the continued growth are still intact if the moat is still there.

That is how all of them made money.

That's how Peter Lynch did it. That's how Nick Sleep did it, how Buffett did it, and even Ben Graham, the father of value investing did it. So many investors made money by just having the discipline to hold onto a stock.

There are a lot of ways to make money in the market, but I continue to believe that this is the best way and most attainable for the average investor. For you and I to be able to accomplish this is really by just compiling a portfolio of great companies and being able to have the discipline to hang on to them.

Hand's off investing strategy

I start every quarter with a snapshot and a portfolio health report, it's part of the Think Week repertoire.

It's fascinating to see the portfolio 8.7% up, but we cannot forget the 16% gains of the S&P500 during the same period.

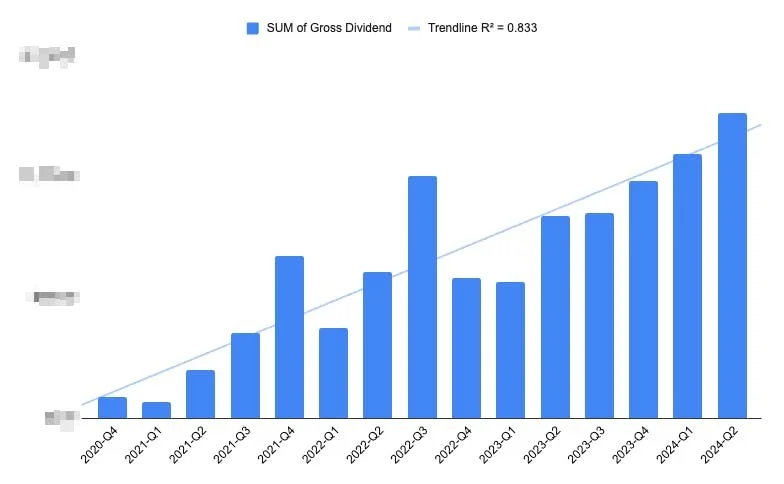

But then I look at the consistent dividend growth, the early days of a compounding machine.

It's in the right direction, I expect to maintain 20% YoY growth — but maybe that accelerates with compounding.

I love investing because it's the best path to financial freedom that I know and have access to.

If you want access to more of my dividend-investing content and research, click here.

I like to be independent, I want to be able to do what I want to do every day, and money lets you do that.

— Warren Buffet