Q3 2024 Quarterly Report

Good morning Investors,

As we close out the third quarter of 2024, I'm pleased to present our portfolio update.

Despite ongoing market volatility, our dividend-focused strategy demonstrates resilience and steady growth.

Portfolio Performance & key metrics

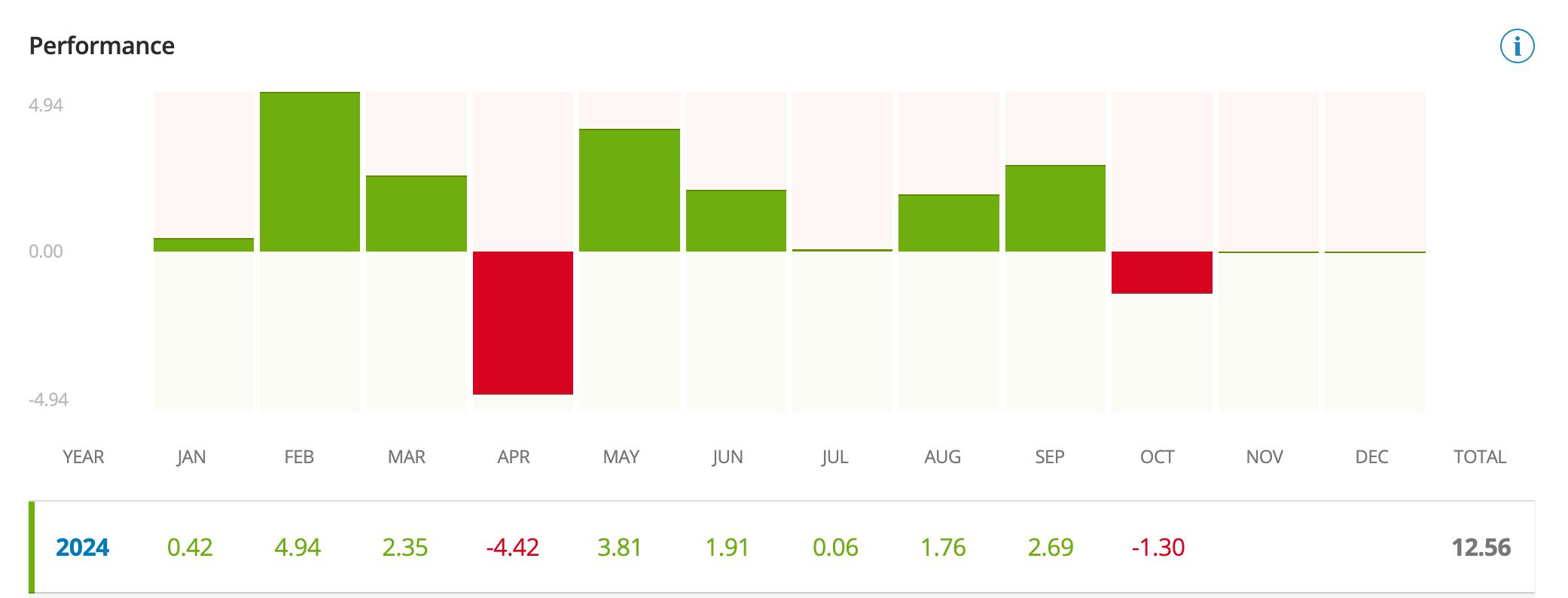

Total Return YTD: +12.56% (vs. S&P 500: +20.18%)

Q3 Performance: +4.51% (July: +0.06%, August: +1.76%, September: +2.69%)

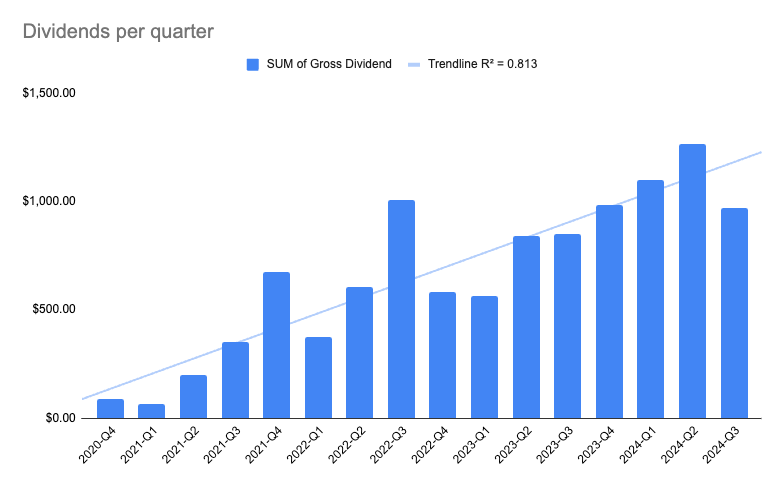

Dividend Yield: 3.8% (Dividend Bets + ETFs, target range: 3.2% - 3.8%)

Dividend Growth: +13.8% YoY (target: 10-20%)

Average Holding Time: 24 months, buy good companies and do nothing.

Risk score: Portfolio remains stable and low risk at 4 out of 10.

Portfolio Composition

Core (ETFs): 62% — target: 65%

Satellite (Individual stocks): 38% — target: 35%

Our current allocation shows a higher percentage in the satellite portion than our target. This is primarily due to strong performance in individual stock picks and the inclusion of cryptocurrency exposure. While this has contributed to our overall returns, it also increases our portfolio's volatility.

Satellite Breakdown:

Dividend Plays: 47.44% of Satellite (27.60% of total portfolio) Includes companies known for their strong dividend payments and growth, such as VICI, O, RY, ENB, PBR, MC.PA (LVMH), VALE

Growth Bets: 40.96% of Satellite (23.83% of total portfolio) consists of high-growth potential stocks like AAPL, MSFT, GOOG, AMZN, SHOP, and PYPL.

Crypto: 11.60% of Satellite (6.75% of total portfolio) Includes BTC, ETH, and ADA.

Looking Ahead

As we enter the final quarter of 2024, we remain cautiously optimistic. Our focus on high-quality, dividend-paying companies with strong balance sheets positions us well for various economic scenarios.

We continue to monitor interest rates and inflation. Still, we do not anticipate any significant change in the portfolio apart from directing new contributions primarily toward Core ETFs to move closer to our 65% target.

We're committed to growing your wealth steadily over time, prioritizing reliable income streams and capital appreciation.

Wealth is built through consistency and patience.

Thank you for your continued trust in Positive Fund Wealth Management. As always, I'm available to discuss any questions or concerns.

Sincerely,

John Ostrowski

Disclaimer: Past performance is not indicative of future results. This report is for informational purposes only and does not constitute investment advice.